2021 Tesla Model 3 SR+ once again makes it to the list of eligible electric cars for the $5,000 Canadian federal tax credit (iZEV Program). This is part of the CAD $487 million future investment in EV infrastructure and tax incentives by the Canadian government.

This incentive program supports Plug-in Hybrid (PHEV) and Hydrogen Fuel Cell vehicles as well. Longer-range zero-emission vehicles are eligible for CAD $5,000 and shorter-range EVs are eligible for a $2,500 incentive.

Model 3 Standard (only available in physical stores) and Standard Range Plus are the only Teslas that have qualified for the Canada iZEV incentive. Being a battery electric vehicle (BEV), Tesla Model 3 is qualified for the max CAD $5,000 tax credit.

Transport Canada website mentions the following criteria for the iZEV incentive eligibility:

There are two levels of incentive:

– Battery-electric, hydrogen fuel cell, and longer-range plug-in hybrid vehicles are eligible for an incentive of $5,000

– Shorter range plug-in hybrid electric vehicles are eligible for an incentive of $2,500

To be eligible for the Incentives for Zero-Emission Vehicles program, you have to purchase or lease:

– A vehicle with six seats or fewer, where the base model (trim) Manufacturer’s Suggested Retail Price (MSRP) is less than $45,000;

— Higher-priced versions (trims) of these vehicles, up to a maximum Manufacturer’s Suggested Retail Price (MSRP) of $55,000, will also be eligible for purchase incentives;

Or

– A vehicle with seven seats or greater, where the base model Manufacturer’s Suggested Retail Price (MSRP) is less than $55,000;

— Higher-priced versions (trims) of these vehicles, up to a maximum Manufacturer’s Suggested Retail Price (MSRP) of $60,000, will also be eligible for purchase incentives;

You will still be eligible for the incentive even if delivery, freight, and other fees, such as vehicle color and add-on accessories, push the actual purchase price over these set limits.

Source: Transport Canada (Read full details)

Because the Tesla Model 3 Standard variant which is only available in Tesla stores only is priced at CAD $44,999 and the Standard Range Plus is $52,990 — it falls perfectly into the eligibility criteria.

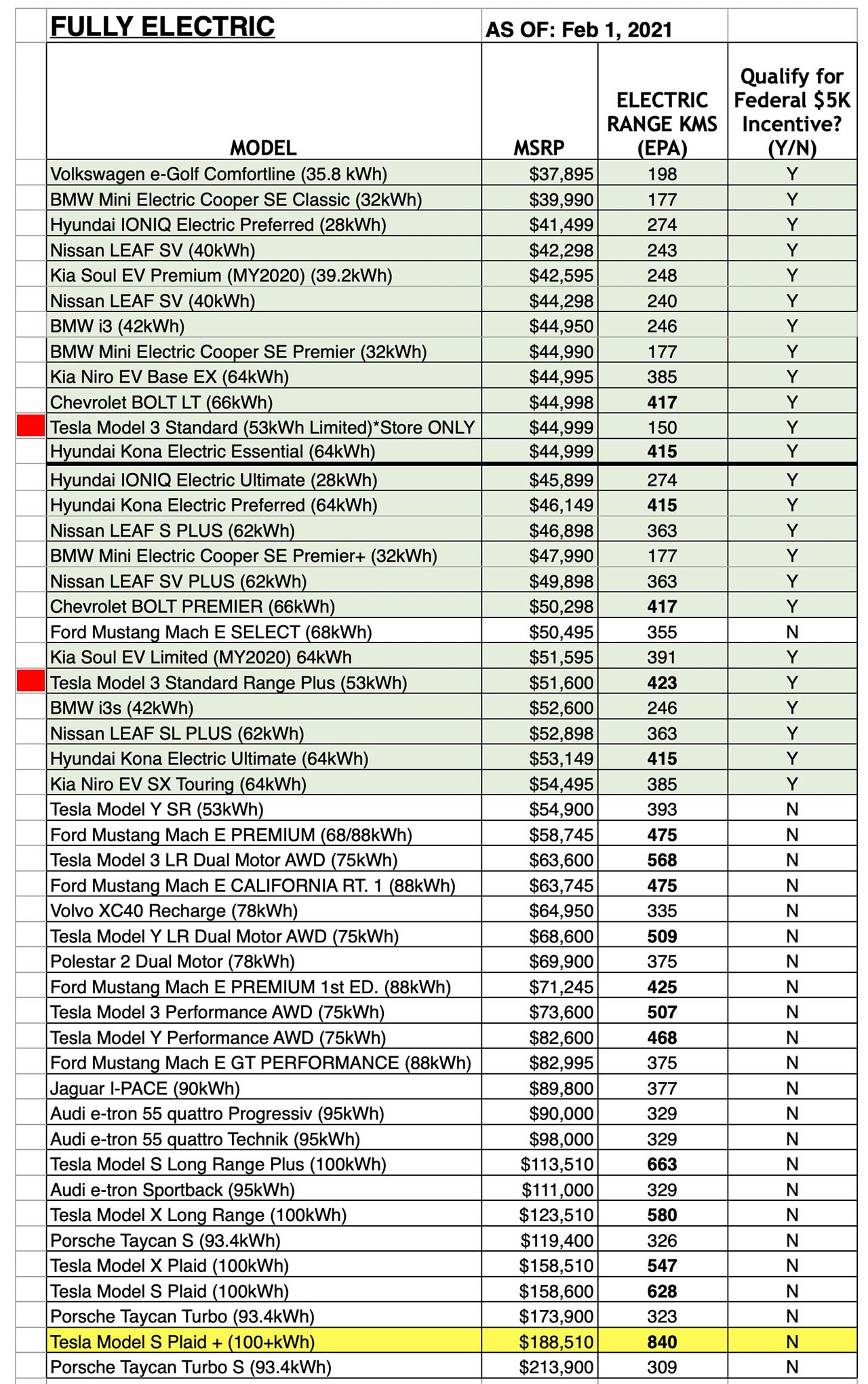

EV Revolution Show (YouTube / Twitter) made the effort to compile the entire list of eligible Canadian iZEV Program EVs and put it inside the following chart (chart last updated on 1st Feb 2021).

Leased zero-emission vehicles are also covered by Canda’s iZEV tax incentive, for 12 month lease the 25% of the incentive is given, for 24 month lease it becomes 50%, and for 36 month lease the incentive is 75%.

For example if a long range EV is eligible for CAD $5,000 incentive, it will get $1,250 for 12 months, $2,500 for 24 months, and $3,750 for 36 month lease.

If a shorter range EV qualifies for $2,500 tax credit, it will receive CAD $625 for 12 months, $1,250 for 24 months, and $1,875 for 36 month lease.

Tesla has listed the Provincial, Territorial, and Local rebates and incentives on the official website.

Stay tuned for more, follow us on Google News | Flipboard | RSS (Feedly).