When accessing the Tesla Model 3 online ordering page for the United States, the electric automaker is showing an important message related to the fading tax credit.

Until 31st December 2023, two variants of the Tesla Model 3 i.e. the base Rear-Wheel Drive (RWD) and the mid-tier Long Range All-Wheel Drive (AWD) are eligible for the full Federal Tax Credit of $7,500. As soon as the next year (2024) begins, these two variants of the Tesla Model 3 will lose the tax credit entirely.

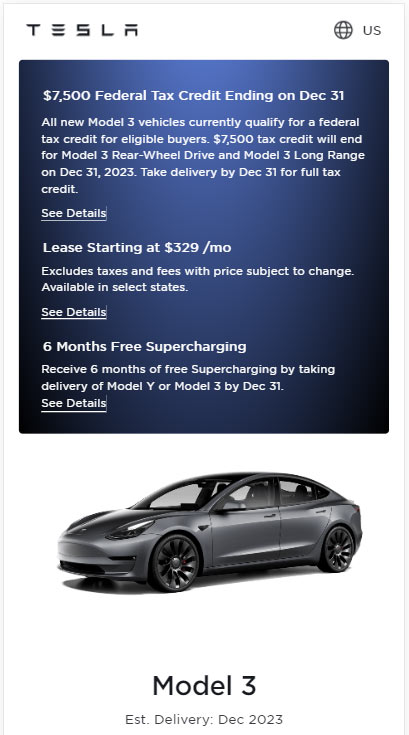

The Tesla Model 3 online ordering page says:

All new Model 3 vehicles currently qualify for a federal tax credit for eligible buyers. $7,500 tax credit will end for Model 3 Rear-Wheel Drive and Model 3 Long Range on Dec 31, 2023. Take delivery by Dec 31 for full tax credit.

This is a surprising notice from Tesla to potential Model 3 buyers. Before this new tax credit notice, it was believed that the federal tax credit of $7,500 would be halved to $3,750 at the start of 2024. However, the new Inflation Reduction Act (IRA) guidance by the IRS disqualifies the Tesla Model 3 RWD and Long Range AWD models entirely from the federal tax credit scheme.

The ‘See Details’ dialog box sheds more light on why Tesla (TSLA) is losing the entire tax credit on these two Model 3 variants. “Tax credit will end for Model 3 Rear-Wheel Drive and Model 3 Long Range on Dec 31 based on current view of new IRA guidance,” Tesla’s website explains.

The US Environmental Protection Agency (EPA) website currently shows Tesla Model 3 RWD and Long Range AWD as eligible for the $7,500 tax credit. The current live version of the IRS guidance webpage for EV tax credit requirements and eligibility does not mention a criteria that disqualifies two Tesla Model 3 variants from the tax credit.

A Tesla Model 3 RWD is priced at $38,990. With the federal tax credit of $7,500, the car can be had for $31,490 and even much lower if there are state-level incentives and rebates involved like in California.

However, it’s unclear at the moment why the IRS selected only Tesla Model 3 RWD and Long Range variants to drop the entire tax credit. The Tesla Model 3 Performance variant still apparently has the full or half credit going into next year.

Tesla is also asking Model Y customers to order their vehicle before 31st December to get the full tax credit of $7,500. However, it’s unclear from the Tesla Model Y configurator page message if the federal tax credit will phase out entirely or be reduced in half. Stay tuned for the updates.

Stay tuned for constant Tesla updates, follow us on:

Google News | Flipboard | X (Twitter) | WhatsApp Channel | RSS (Feedly).

Related

- Tesla replaces standard Autopilot with TACC, Musk explains why

- Tesla begins Robotaxi service without safety monitors (Unsupervised FSD) in Austin, Texas (videos)

- Tesla offers a 5-year, Unlimited KMs warranty on 2026 Model 3 and Model Y in Australia and New Zealand

- Cop pulls over a Tesla Model Y Juniper because of its taillight design

- Tesla Model Y falls off a cliff in China, occupants walk away safely

- Model Y Performance starts appearing in Tesla showrooms in the US