The Tesla (TSLA) Q2 2025 Earnings Call was no doubt one of the toughest to handle for the company’s CEO Elon Musk and his team of executives.

The depressing live webcast and Q&A resulted in a ~10% downslide on Thursday. Interestingly, wise investors and believers in the company’s mission took it as an opportunity and bought the dip.

Interestingly, this group of investors wasn’t just comprised of retail investors (Tesla fans); a big institutional investor, Ark Invest also saw a big opportunity and increased its TSLA position.

Cathie Wood of Ark Invest decided to buy 143,190 shares of Tesla stock on the following day of the Q2 Earnings Call. This move reflected in the next day’s trading of Tesla shares on the NASDAQ, the stock jumped back on Friday, but didn’t fully recover.

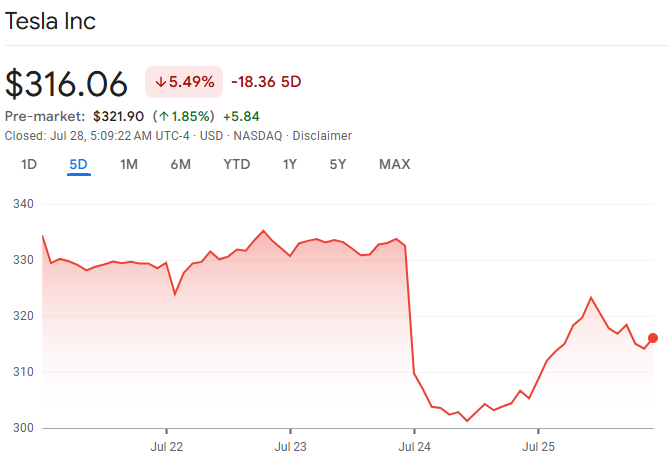

Tesla Stock: Pre and Post Q2 2025 Earnings Call

On the Q2 2025 Earnings Call day (23 July), Tesla (TSLA) stock closed at $332.56. By the afternoon of Thursday, 24th July, the stock price slumped to its lowest of $301.24 (a drop of around ~10%). After this low, TSLA slowly climbed throughout the day and closed at $305.30.

On Friday morning, the news of Ark Invest buying a large number of Tesla shares broke. This triggered a hike in the Tesla stock price and the stock closed at $316.06 on Friday. It’s a partial recovery, but at least a good comeback.

As a result of this drop after the Q2 call, Tesla lost its $1 trillion market cap. Currently, it’s standing at $990.30 billion.

It will be an interesting

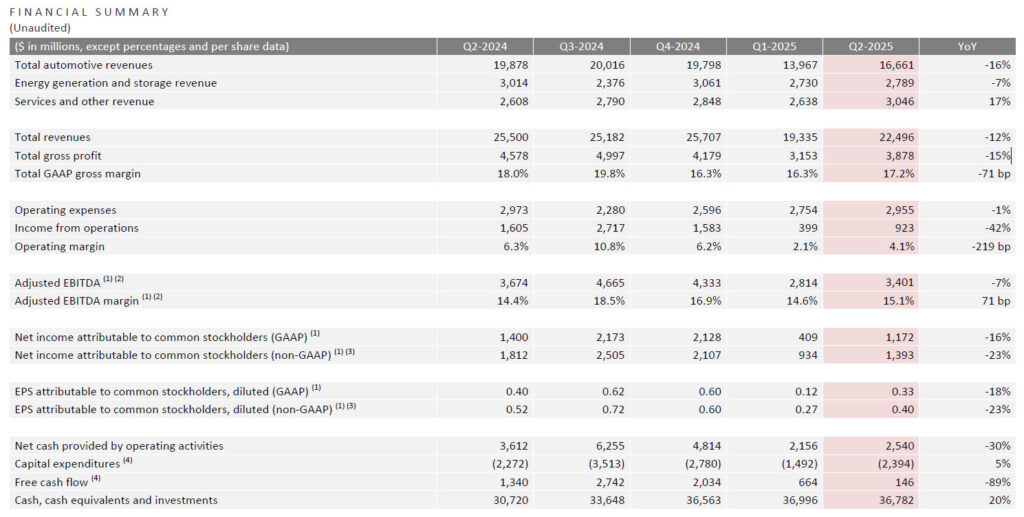

Tesla Q2 2025 Financial Summary

Tesla delivered significantly more electric vehicles in Q2 2025 compared to the first quarter of the year. The increased sales of cars translated into a higher automotive revenue figure in the 2nd quarter.

Tesla’s automotive revenues stood at $16,661 million ($16.661 billion) in Q2. Although it’s an increase of around 19% QoQ, Tesla’s Q2 revenues dropped by -16% year-over-year (YoY).

Interestingly, Tesla’s ‘Services and other’ revenue increased by 15% QoQ and 17% YoY in Q2. This revenue includes regulatory credits that Tesla earned from other automakers not meeting the emissions standards in the EU.

Full Self-Driving Regulatory Hurdles

During the Q2 2024 Earnings Call (listen above), Tesla CEO Elon Musk talked in detail about the regulatory hurdles the company is facing in Europe and China for launching its Autopilot Full Self-Driving (FSD).

Tesla launched FSD in China earlier this year, but the automaker was stopped by the Chinese regulatory body from distributing the AI self-driving software and its marketing. Tesla is still working on compliance with Chinese authorities to roll out FSD in China.

Tesla successfully launched the Robotaxi Service in Austin, Texas last month. However, the automaker is facing regulatory approval issues for the Robotaxi launch in California (San Francisco Bay Area).

According to Elon Musk, as these regulatory hurdles are overcome one by one, Tesla’s FSD AI system holds great potential for the future of the company.

Stay tuned for constant Tesla updates, follow us on:

Google News | Flipboard | X (Twitter) | WhatsApp Channel | RSS (Feedly).

Related Tesla News

- Tesla expands the rollout of FSD v14.2.2.4 (2025.45.9), release notes and first impression videos

- Tesla hands over around 100 Cybertrucks on the first day of UAE deliveries

- Tesla replaces standard Autopilot with TACC, Musk explains why

- Tesla begins Robotaxi service without safety monitors (Unsupervised FSD) in Austin, Texas (videos)

- Musk-Ryanair spat gave the airline good publicity, says CEO O’Leary in his press conference (complete video)

- Ryanair calls out Elon Musk on X, Michael O’Leary to hold a press conference today