The Tesla (TSLA) Q4 2025 Earnings Call was important because it covered the company’s performance for the year and provided its outlook and goals for the future.

In his opening remarks, Elon Musk mostly covered Tesla’s plans for 2026 and the transition of the company from an EV manufacturer to a full-blown real-world AI and robotics company.

On the financial front, Tesla performed well despite a lower number of car deliveries compared to last year (details below). The company is doing well in the energy storage business (Megapack, solar, and Powerwall).

The major news Musk revealed during the Earnings Call (recording below) is the discontinuation of the Model S and Model X from next quarter. In place of the Model S/X plant in Fremont, Tesla will start production of its Optimus humanoid robot.

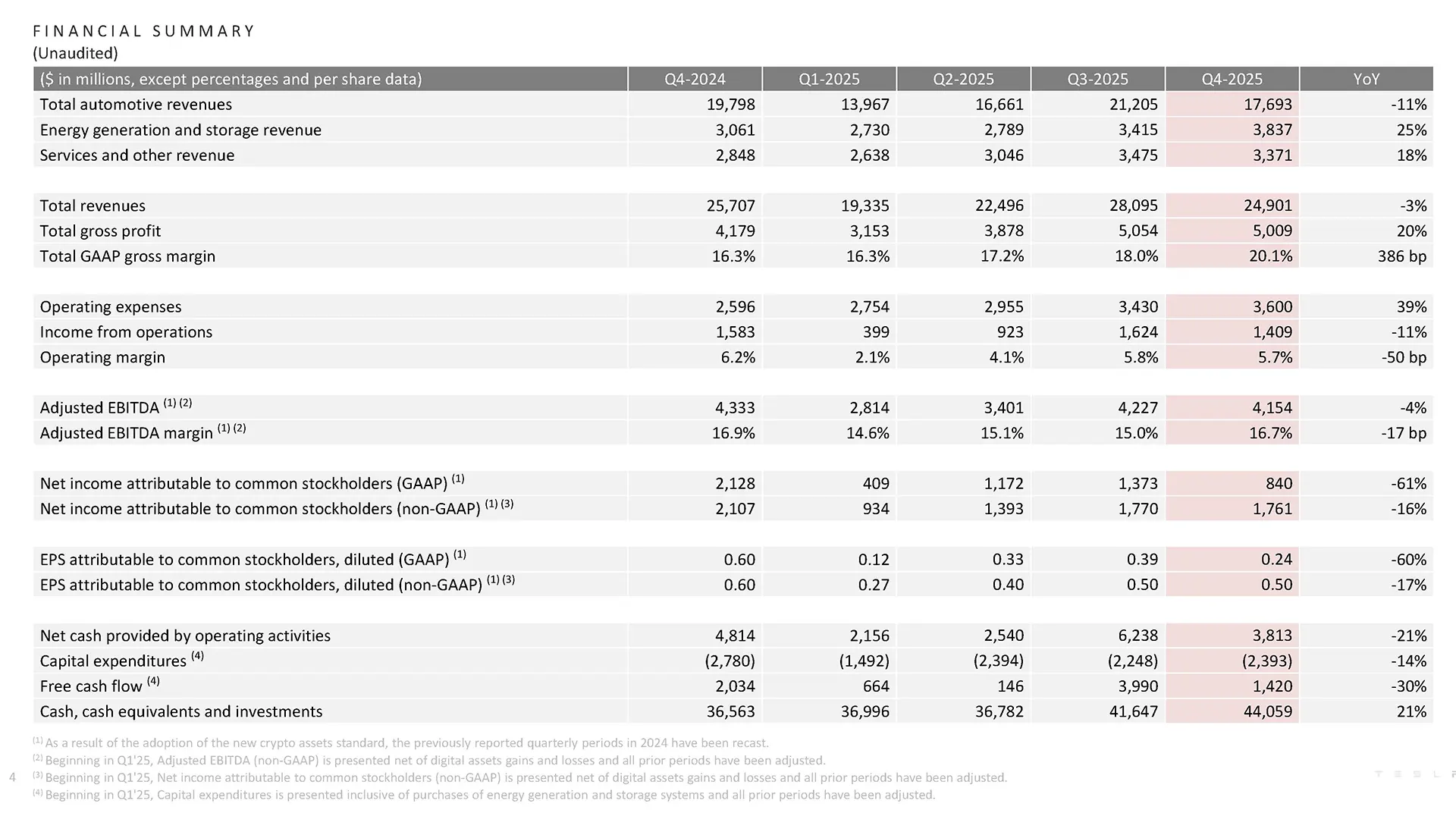

Tesla (TSLA) Q4 2025: Year-over-Year (YoY) Comparison

We’ve already covered Tesla’s Q4 and entire 2025 vehicle deliveries and energy business in a previous report. According to Tesla CFO Vaibhav Taneja, Tesla’s automotive margins excluding regulatory credits improved sequentially from 15.4% to 17.7% YoY.

Although the total revenues dropped in Q4 2025 vs the same quarter last year, the total GAAP gross margin increased from 16.3% to 20.1% (386 bp) compared to Q4 2024.

Total gross profit also increased by 20% in Q4 2025 compared to the same quarter last year ($5.009 vs $4.179 billion). This suggests that Tesla has optimized its automotive and energy business margins, resulting in increased profits despite a lower number of deliveries.

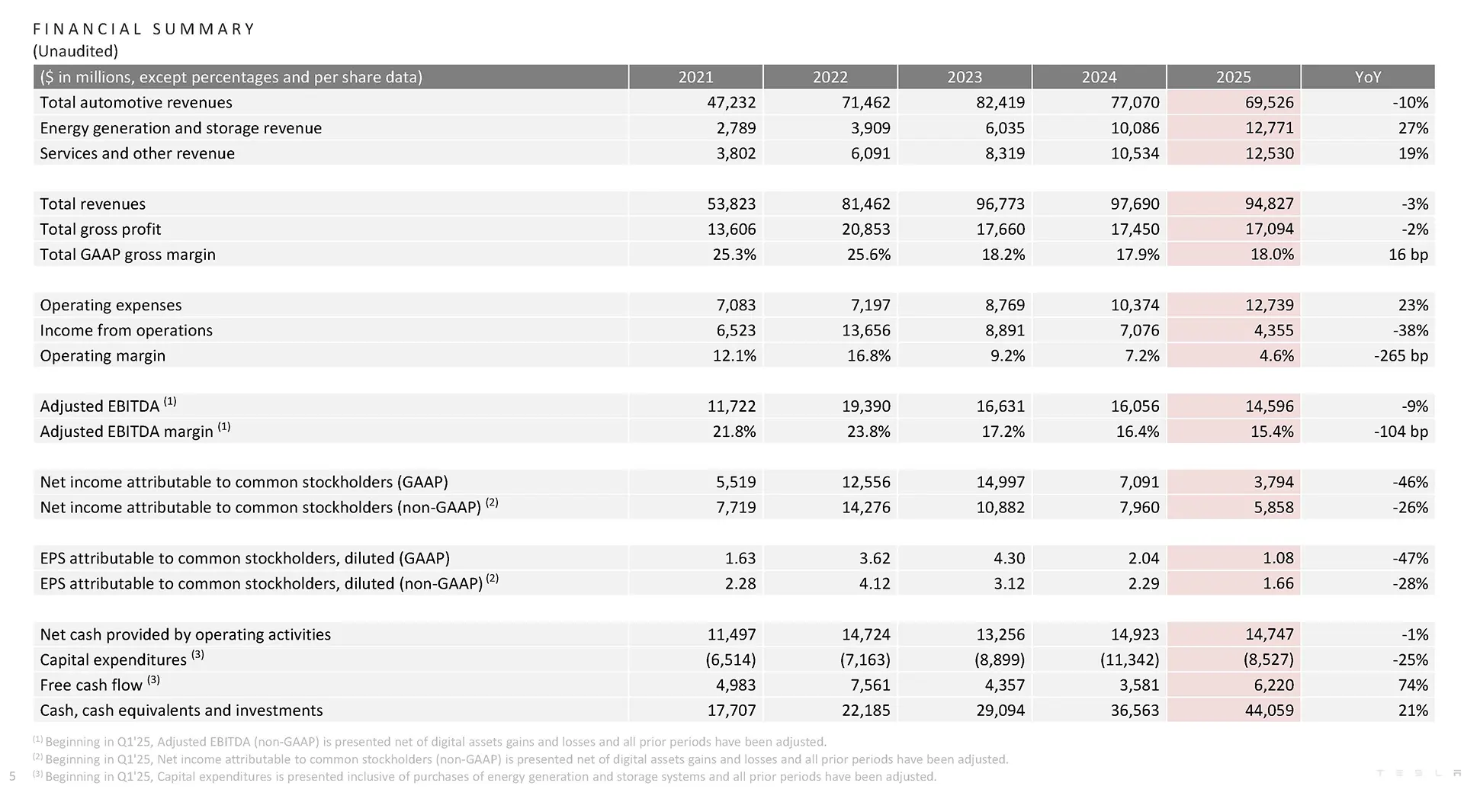

In the entire 2025, Tesla’s automotive revenues dropped by 10% compared to 2024 ($69.526 vs $77.07 billion). However, the total revenues, including energy, regulatory credits, and services, dropped by 3% ($94.827 vs $97.690 billion).

The loss of revenue from lower automotive sales was compensated for by revenue generated from other sources.

Key Takeaways from the Q4 2025 Earnings Call

- Tesla to end Model S and Model X production in Q2 2026

- The space created at the Fremont factory will be utilized to manufacture Tesla Optimus humanoid robots

- Discontinuation of Model S/X is part of Tesla’s shift to an autonomous future with FSD and robots

- Tesla has started the Robotaxi service in Austin, Texas, without safety monitors

- Overall, Elon Musk focused on the development of the Optimus robot

- The advent of Unsupervised FSD is closer than the expectations of most critics

- Tesla creates value by solving hard problems. Full Self-Driving, AI, and general-purpose robotics are the prime examples of hard problems

- Tesla has invested $2 billion in xAI for strategic reasons, and the integration of Grok AI in Tesla vehicles

- US demand for Tesla’s electric vehicles was lower in Q4 compared to Q3, but the automaker saw a surge in demand from smaller countries like Malaysia, Taiwan, Saudi Arabia, Norway, Poland, and the Asia Pacific

- Tesla has increased its automotive margins despite a lower number of sales

- Tesla is preparing to ramp up production at all of its factories in 2026

- Tesla is now using the 4680 cells in non-structural battery packs as well

- Tesla has now around 1.1 million paid FSD customers worldwide, out of which 70% have paid upfront

- Tesla is moving to a subscription-only FSD pricing model this month

- Automotive marins in the short-term will be impacted by adopting the subscription-based model for FSD

- Tesla has produced 9 million vehicles globally

- 6 million drive units (motors) have been produced at Giga Nevada alone

- The EV automaker shared the planned locations of Tesla Semi Megacharger stations across the US

Stay tuned for constant Tesla updates, follow us on:

Google News | Flipboard | X (Twitter) | WhatsApp Channel | RSS (Feedly).

Related Tesla Quarterly News

- Tesla Q4 2025: Financial Results, Key Takeaways from Elon Musk’s Earnings Call, more

- Tesla Q4 2025: vehicle deliveries drop, QoQ and YoY comparisons, energy business shows compelling growth, more

- Tesla Q3 2025: Financial updates and key takeaways from the earnings call

- Tesla (TSLA) crushes critics by delivering around ~500k EVs in Q3 2025

- Tesla (TSLA) stock slumped after Q2 2025 Earnings Call, Ark Invest bought 143k shares, stock partially recovered, more

- Tesla (TSLA) announces date and time of the Q2 2025 Earnings Call