Tesla, Inc. (TSLA) has released its Q2 2021 earnings report that documents another record quarter in automaker’s short history of mass production of cars.

The best thing about Tesla’s 2nd quarter earnings of this year is that despite the number of regulatory credits dropping significantly, Tesla still scored a profit. TSLA bears in the past have been saying that the automaker will not be able to make a profit without these massive regulatory credits. But Tesla has yet again busted this assumption with its resilience under the leadership of Elon Musk.

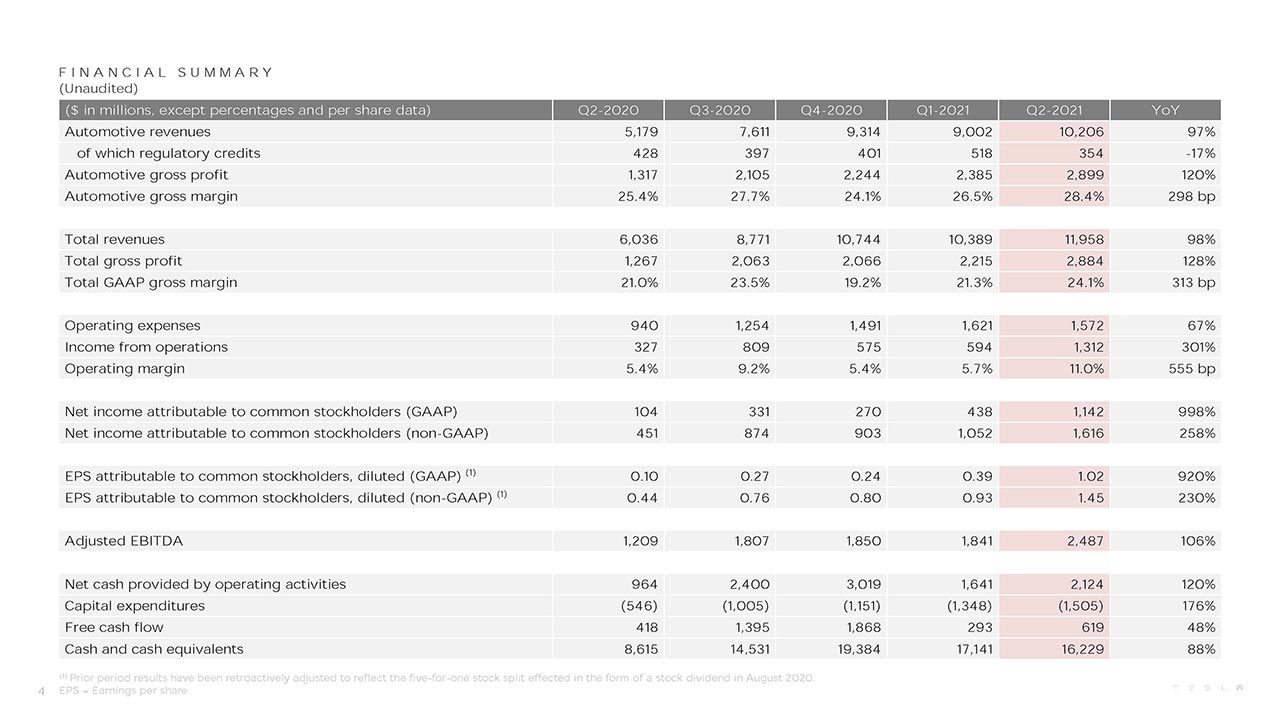

Tesla received $354M in regulatory credits vs. $518M in Q1 2021, this is a -31.6% drop QoQ. Compared to Q2 2020 ($428M), the number of regulatory credits has dropped -17%.

Even with this drop in EV credits, Tesla has managed to earn a GAAP net income of $1.3B for the first time ever — crushing all expectations.

In the second quarter of 2021, we broke new and notable records.

We produced and delivered over 200,000 vehicles, achieved an

operating margin of 11.0% and exceeded $1B of GAAP net income for the

first time in our history.Supply chain challenges, in particular global semiconductor shortages

and port congestion, continued to be present in Q2. The Tesla team,

including supply chain, software development and our factories, worked

extremely hard to keep production running as close to full capacity as

possible. With global vehicle demand at record levels, component

supply will have a strong influence on the rate of our delivery growth for

the rest of this year.We successfully launched Tesla Vision in Q2, which was mainly possible

Summary of Q2 2021 earnings. Source: Tesla Earnings PDF.

due to our ability to use data from over a million Tesla vehicles to source

a large, diverse and accurate dataset. Solving full autonomy is a difficult

engineering challenge in which we continue to believe can only be

solved through the collection of large, real-world datasets and cuttingedge AI.

Public sentiment and support for electric vehicles seems to be at a

never-before-seen inflection point. We continue to work hard to drive

down costs and increase our rate of production to make electric vehicles

accessible to as many people as possible.

CEO Elon Musk and other top Tesla executives also addressed the Q2 2021 Earnings Call yesterday. “Q2 2021 was a record quarter on many levels, we reached record production, deliveries and surpassed over a billion dollars in net GAAP income for the first time in history,” said Elon Musk in his opening remarks of the earnings call (listen to the complete call below).

Musk reiterated that the global chip supply shortage is a bottleneck for Tesla’s production and this is a limiting factor that is out of the automaker’s control. The demand for Tesla electric cars has surpassed its ability to produce and deliver, especially to Europe.

Musk also thinks that Tesla is one of the few companies in history to ramp up large-scale manufacturing this fast, maybe the Ford Model T back in the day must have been comparable to these levels.

The call also discusses the Cybertruck production, Model Y production at Giga Berlin and Giga Texas, and FSD subscriptions, that we will cover in posts from tomorrow. For now, our favorite Tesla podcast by Rob Maurer has some interesting views to share, let’s listen to him below.

Stay tuned as we cover the Tesla Q2 2021, follow us on:

Google News | Flipboard | RSS (Feedly).