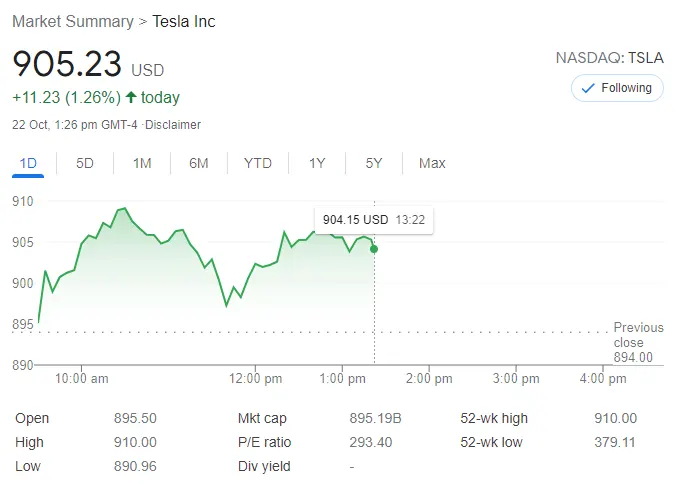

Tesla (TSLA) stock price hit a new all-time high of $894.00 at market close yesterday. This morning, the stock is still rallying, and the accelerator is Tesla’s Q3 2021 record profitable quarter.

At the time of this writing, TSLA is trading between $904 & $905 (NASDAQ: TSLA) — another all-time high. The outlook for Tesla is looking even better today, TSLA bulls are winning the show.

As we reported earlier this month that Tesla was able to deliver 20% more vehicles in Q3 2021 compared to the previous quarter and 70% higher than the same quarter last year. This sudden jump in deliveries has resulted in another record profit (5th in a row).

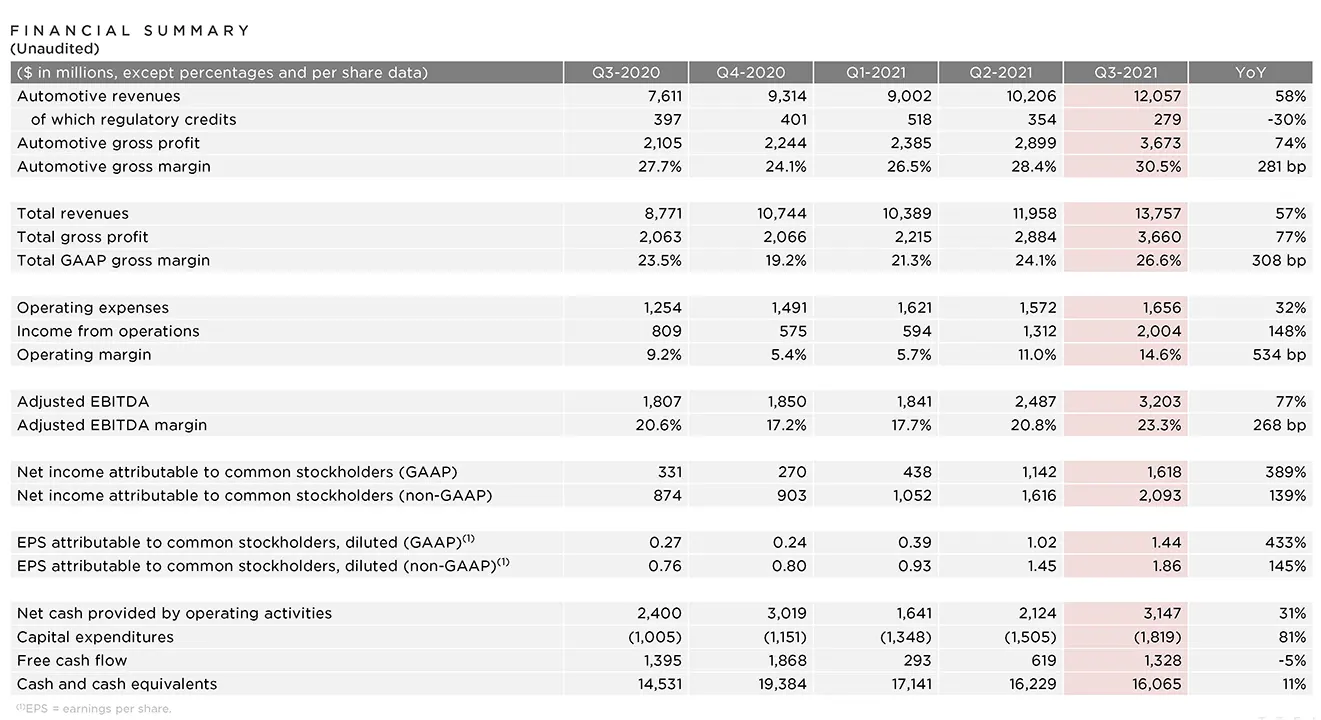

Financial Summary and Profitability

$2.0B GAAP operating income; 14.6% operating margin in Q3

Source: Tesla Q3 2021 shareholder deck (PDF)

$1.6B GAAP net income;$2.1Bnon-GAAP net income (ex-SBC1) in Q3

30.5% GAAP Automotive gross margin (28.8% ex-credits) in Q3

This time, Tesla CEO Elon Musk did not join the Q3 2021 Earnings Call on Wednesday (listen below) as he had said during the Q2 2021 call. Tesla shared the following summary of its Q3 2021 performance:

The third quarter of 2021 was a record quarter in many respects. We achieved our best-ever net income, operating profit and gross profit. Additionally, we reached an operating margin of 14.6%, exceeding our medium-term guidance of “operating margin in low-teens”.

Perhaps more impressively, this level of profitability was achieved while our ASP (average selling price) decreased by 6% YoY in Q3 due to continued mix shift towards lower-priced vehicles. Our operating margin reached an all-time high as we continue to reduce cost at a higher rate than declines in ASP.

EV demand continues to go through a structural shift. We believe the more vehicles we have on the road,the more Tesla owners are able tospread the word about the benefits of EVs. While Fremont factory produced more cars in the last 12 months than in any other year, we believe there is room for continued improvement. Additionally, we continue to ramp Gigafactory Shanghai and build new capacity in Texas and Berlin.

A variety of challenges, including semiconductor shortages, congestion at ports and rolling blackouts, have been impacting our ability to keep factories running at full speed. We believe our supply chain, engineering and production teams have been dealing with these global challenges with ingenuity, agility and flexibility that is unparalleled in the automotive industry. We would like to thank everyone who helps advance our mission.

Source: Tesla Q3 2021 shareholder deck (PDF)

Reaching 1 million annualized vehicle production rate

This time, Tesla CFO Zachary Kirkhorn delivered the opening remarks instead of Elon Musk. Zachary also notified that Tesla has reached an annualized production run rate of 1 million vehicles per year towards the end of Q3 2021.

“The increase in production rate has primarily been driven by further ramping of the Model Y at our Shanghai factory. Additionally, we have made great progress increasing production volumes of Model S, and recently started the ramp and deliveries of Model X,” Zachary Kirkhorn explained the exponential growth in Tesla production at Giga Shanghai and the Fremont factory.

According to Tesla, the demand for the new 2021 Model S & Model X design refresh is also on historic levels. So, the automaker is also planning to expand the production of its flagship Model S sedan and the Model X SUV.

With Gigafactory Texas and Gigafactory Berlin joining the production mix early next year, Tesla will be able to ramp vehicle production significantly beyond 1 million cars a year.

Stay tuned for constant Tesla updates, follow us on:

Google News | Flipboard | RSS (Feedly).