By now we know that Tesla (TSLA) is all set to be listed as an S&P 500 by the 21st of December, announced in a press release by S&P Dow Jones Indices earlier this week.

As of this writing, Tesla has reached a massive market cap of $431.42 billion, making it the largest ever company to be added to the S&P 500 index. For this very reason, the S&P Dow Jones Indices is waiting on feedback from its investors if TSLA should be added to the index at once or in two phases.

Tesla Inc. (NASD:TSLA) will be added to the S&P 500 effective prior to the open of trading on Monday, December 21 to coincide with the December quarterly rebalance. Due to the large size of the addition, S&P Dow Jones Indices is seeking feedback through a consultation to the investment community to determine if Tesla should be added all at once on the rebalance effective date or in two separate tranches ending on the rebalance effective date. Tesla will replace an S&P 500 company to be named in a separate press release closer to the rebalance effective date.

S&P Dow Jones Indices / Press Release

When we last reported on the possible inclusion of TSLA to the S&P 500 index in June, we discussed all the opportunities and benefits that come with this achievement.

Now the New York-based Morgan Stanley investment firm has increased its price target for TSLA from $360 to $540 and at the time of this writing, TSLA’s share price has already reached $455.92.

Morgan Stanley thinks you cannot estimate Tesla’s worth by only looking at it as a car company, the other business models and revenue streams like FSD Software and Energy Storage should also be considered.

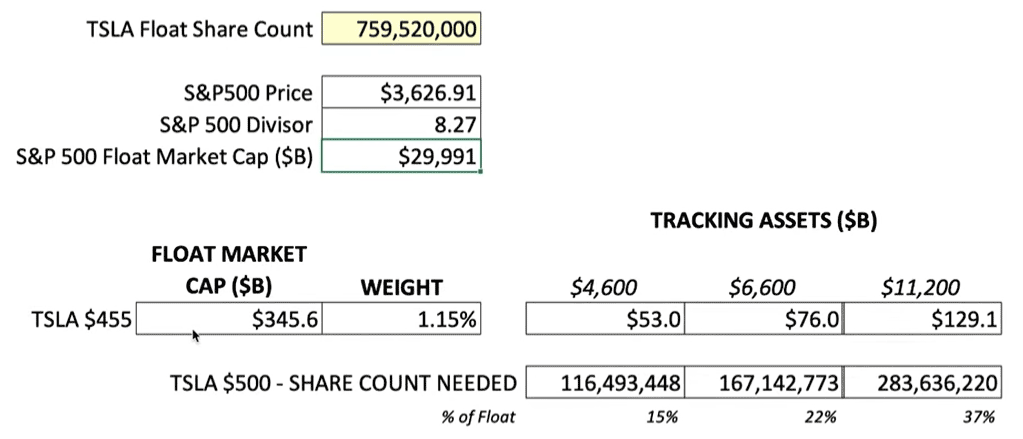

Dow Jones Indices estimates that TSLA stock’s Approximate Pro-Forma Weight in S&P 500 index will be 1.01% with an estimated funding trade* of ~$51 billion. With the world’s 500 top companies in the pool, a 1% share in the entire S&P 500 cluster is a significant chunk of the trade.

*The estimated funding trade is calculated using an estimate of % of assets indexed to the S&P 500 derived from S&P DJI’s Annual Survey of Assets as of Dec 31, 2019, multiplied by the approximate Pro-forma Weight of TSLA in the SS&P 500 as of 11/13/2020.

Source: S&P DJI

Tesla bull Rob Maurer deeply analysis TSLA S&P 500 in the following video and explains the Tesla float market cap chart we can see above.

Stay tuned for more updates and articles, follow us on:

Google News | Flipboard | RSS (Feedly).

More on Tesla:

- Tesla expands the rollout of FSD v12.5 to Hardware 4 vehicles, no sign of it on Cybertruck yet

- Tesla (TSLA) Q2 2024 Earnings Call: Elon Musk talks about Robotaxi, FSD, Optimus, Roadster, Dojo, and the next-gen affordable EV

- Tesla begins the rollout of FSD v12.5 to employees and select external testers (first impressions)

- Watch the new Tesla Model 3 Performance run a quarter-mile in under 11 seconds

- Tesla (TSLA) wins a multi-billion dollar Megapack deal for battery energy projects in California and Texas

- Tesla (TSLA) raises prices of its flagship Model S and Model X EVs in the US and Canada