Tesla (TSLA) shares are once again through the roof as the company announced its surprising quarterly production and delivery numbers despite the coronavirus pandemic (pdf below) — hailing from the Silicon Valley, Tesla is now on the verge of becoming an S&P 500 company.

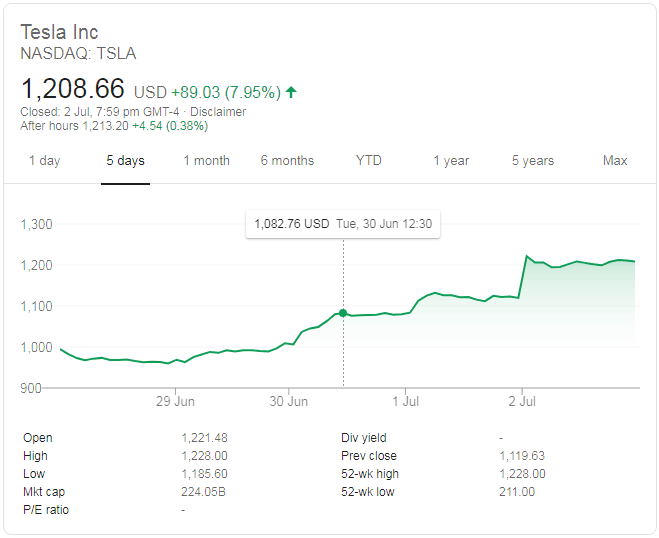

What this means for existing investors and the automaker itself is stepping up the game to a serious next level, with the current share price of $1,208, Tesla has already become the world’s most valuable automotive manufacturer with a market capitalization of $224.05 billion dollars.

Interestingly, Tesla has ramped production to the pre-pandemic levels at the Fremont factory where production was stopped by the Alameda County with shelter-in-place orders, Tesla even sued the county for not letting them open the factory even after implementing full safety SOPs.

Latest: Tesla will be included in the S&P 500 index on Dec 21st, 2020.

What it means to be an S&P 500 and what’s in it for Tesla

Thanks to Zac and Jesse from the Now You Know YouTube channel for educating us on what benefits actually are there for the companies that do qualify for inclusion in the S&P 500 index (video below) — in simple words, Tesla will be in the same league as the giants like Apple, Microsoft, Facebook, General Electric to name a few.

If Tesla is able to pull even the smallest profit, there is a chance that it will qualify for inclusion in the S&P 500 index, by looking at the delivery numbers above Tesla has actually delivered 2,250 more cars than it did in the first quarter of 2020 (Gigafactory Shanghai definitely played an important role here) — and with fewer deliveries last quarter, Tesla posted a profit.

As soon as Tesla makes it to the S&P 500 index, it will be considered one of the safest investments as the demand for TSLA shares by the S&P 500 index funds surges, because of the limited availability of the of tradeable float shares is only 147.87 million as of today, big investors are bound to get a good piece for their illustrious portfolio.

This will further strengthen Tesla’s image as an established company rather than a startup which is perceived to be burning investor cash all the time and since Giga Berlin and the next US Gigafactory are on Tesla’s agenda this year, the growth of the company will be exponential — now raising capital by either lending or issuing new shares.

When Ark Invest CEO said that this is just the beginning for Tesla and they are looking at a $7,000 per share TSLA price in 2024, most didn’t believe her, now day by day, it’s becoming a reality.

The workforce already employed by the traditional automakers should prepare their resumes for Tesla as the exponential growth of the automaker will put a further dent in the sales of big automotive companies as they are already suffering from the COVID-19 situation, the only one making progress is Tesla.

Enjoy the in-depth and interesting conversation on this topic in the following video and don’t forget the leave your comments below.

Related Tesla News and Stories:

- Tesla (TSLA) Q2 2024 Earnings Call: Elon Musk talks about Robotaxi, FSD, Optimus, Roadster, Dojo, and the next-gen affordable EV

- Tesla (TSLA) stock grew more than 40% in an 11-day rally

- Tesla (TSLA) makes a comeback with 57,146 more EVs delivered in Q2 2024 compared to Q1

- Tesla Semi spotted with a suite of sensors on the roof, Elon Musk approves its volume production

- Tesla adds Quicksilver color to Model Y in the US, base RWD gets a $2,000 price hike with improved range

- Tesla (TSLA) sold 1.2 million Model Y EVs in 2023, 15 GWh of energy storage, Musk predicts slower growth in 2024, more

- Elon Musk hints at investing in Turkiye and attending the Teknofest next year