Tesla just scored another profitable quarter, actually the 5th consecutive one. The times have gone when TSLA bears challenged the automaker to turn a profit, not anymore.

Tesla CEO Elon Musk conducted the Q3 2020 Tesla Earnings Call with joy and excitement as he announced a historic quarter. Money things aside, Tesla actually delivered a ton of new advancements on the technology front as well demonstrated on Battery Day and Full Self-Driving Beta release.

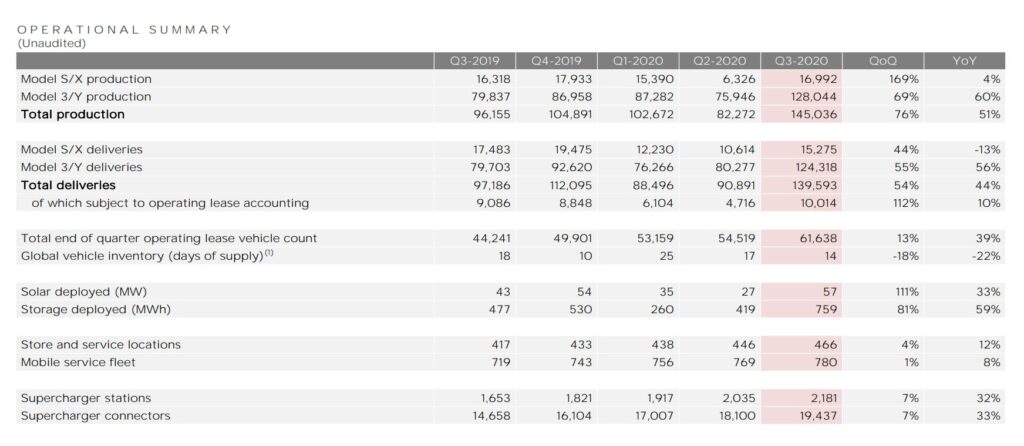

Looking at the Operational Summary below, Tesla has made a quantum leap in Tesla Model Y and Model 3 production and deliveries. The Model 3/Y production grew by 69% QoQ and 60% YoY compared to Q3 2019.

Besides Tesla’s achievements in vehicle production and deliveries, the Tesla Energy department also did well in Q3 2020. Tesla saw a massive growth of 111% QoQ & 33% YoY in Solar and a surge of 81% QoQ & 59% YoY in energy storage deployment. Major thanks to one of the world’s largest energy projects Tesla is doing in Moss Landing, Calfornia.

Our friends over at CleanTechnica recorded the Tesla Q3 2020 Earnings Call and made it available on their YouTube channel, let’s listen to Elon Musk and other executives from Tesla discussing Q3 and answering the tough questions.

Fiat Chrysler’s regulatory credits had their fair share in Q3 2020 profits. Tesla sold $379M in regulatory credits added to the revenue, this is almost double the number of credits compared to last year’s.

The growth of Tesla Energy with 57 MW of solar and 759 MWh of energy storage added $579M into Tesla’s revenue stream. This is over-delivery from even the most bullish estimates, Tesla is just crushing the best of expectations even.

Tesla’s gross automotive gross margins excluding regulatory credits stood at 23.7%. This is a 5% point increase compared to Q2 2020 — again a tremendous achievement by Tesla. Although Q2 was plagued by the COVID-19 situation, Tesla’s gross margin even grew past Q1 2020’s figure of 20.0% ex regulatory credits.

Rob Maurer of the Tesla Daily podcast analyzed the Tesla Q3 2020 numbers in much detail in his episode titled Why Tesla Dominated Q3.

Stay tuned for more and more Tesla news, videos, and updates, follow us on:

Google News | Flipboard | RSS (Feedly).

Related Articles:

- Tesla expands the rollout of FSD v12.5 to Hardware 4 vehicles, no sign of it on Cybertruck yet

- Tesla (TSLA) Q2 2024 Earnings Call: Elon Musk talks about Robotaxi, FSD, Optimus, Roadster, Dojo, and the next-gen affordable EV

- Tesla begins the rollout of FSD v12.5 to employees and select external testers (first impressions)

- Watch the new Tesla Model 3 Performance run a quarter-mile in under 11 seconds

- Tesla (TSLA) wins a multi-billion dollar Megapack deal for battery energy projects in California and Texas

- Tesla (TSLA) raises prices of its flagship Model S and Model X EVs in the US and Canada