Tesla (TSLA) has announced the 3-for-1 stock split after the voting was held at the company’s 2022 Shareholder Meeting that took place at Giga Texas and simultaneously virtually online on Thursday 4th August 2022.

The proposal for the three-for-one stock split was voted in favor by the majority of retail and institutional Tesla stockholders globally.

The Austin, Texas-based automaker reported the 3-for-1 stock split decision to the United States Securities and Exchange Commission in an 8-K filing on the same day as the 2022 Annual Meeting (PDF below).

Additionally, a press release was circulated by Tesla explaining the details of the 2nd stock split in the company’s short history of 12 years since its IPO on 29th June 2010.

AUSTIN, Texas, August 5, 2022 – Tesla, Inc. (“Tesla”) announced today that the Board of Directors has approved and declared a three-for-one split of Tesla’s common stock in the form of a stock dividend to make stock ownership more accessible to employees and investors. Each stockholder of record on August 17, 2022 will receive a dividend of two additional shares of common stock for each then-held share, to be distributed after close of trading on August 24, 2022. Trading will begin on a stock split-adjusted basis on August 25, 2022.

Tesla 3-for-1 stock split press release via the SEC.

In short, for example, if a person has 1 share of Tesla (TSLA) stock on 17th August 2022, he/she will have 3 shares of the company after the market close on Wednesday 24th August 2022. On the next day, i.e. 25th August 2022, the owner of these 3 shares will be able to start trading with the newly-gained TSLA shares.

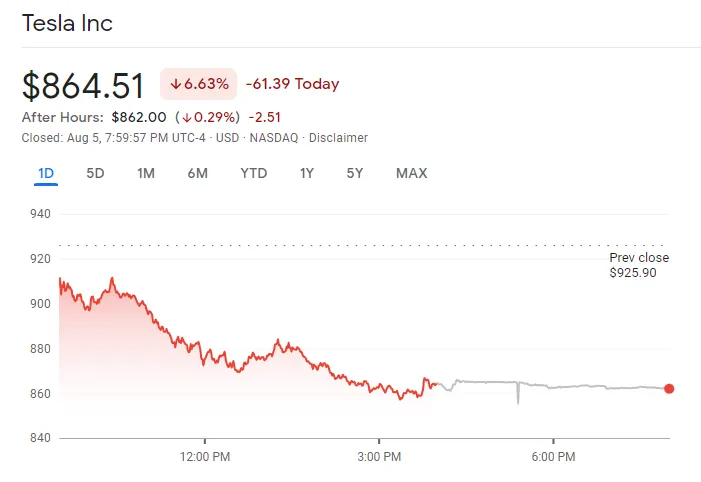

Tesla shares on NASDAQ dropped by 6.63% at market close on Friday 5th August 2022 with a price of $864.51 USD.

This stock split move by Tesla is aimed at making investment easier for company employees and enthusiastic retail investors. Tesla’s stock price on 24th August will determine how affordable a Tesla share will be for small and individual investors.

815,823,639 votes were cast in the favor of the Tesla three-for-one stock split while 4,946,671 were against the decision while 5,930,942 voters abstained from voting.

A total of 13 proposals were part of the 2022 Tesla Annual Shareholder Meeting agenda of which only 4 proposals were approved including the three-for-one stock split.

The other three approved proposals include the appointment of Ira Ehrenpreis and Kathleen William Thompson to the Tesla Board of Directors (Class III) for the next three years, the appointment of PricewaterhouseCoopers LLP as Tesla’s publicly-registered accounting firm for the rest of 2022, and the stockholder proposal regarding proxy access.

Stay tuned for constant Tesla updates, follow us on:

Google News | Flipboard | RSS (Feedly).

Related

- Tesla (TSLA) Q2 2024 Earnings Call: Elon Musk talks about Robotaxi, FSD, Optimus, Roadster, Dojo, and the next-gen affordable EV

- Tesla (TSLA) stock grew more than 40% in an 11-day rally

- Tesla (TSLA) makes a comeback with 57,146 more EVs delivered in Q2 2024 compared to Q1

- Elon Musk on Tesla (TSLA) Q1 call: 2024 deliveries, next-gen car, full autonomy, Robotaxi, more

- Tesla (TSLA) vehicle deliveries drop in Q1 2024 by 20% QoQ — but it still did better than BYD

- Tesla (TSLA) sold 1.2 million Model Y EVs in 2023, 15 GWh of energy storage, Musk predicts slower growth in 2024, more

Not clear about the Lame Duck grey area between Aug 17th and Aug 24th. What exactly happens to stock and concept what might happen in regards to trading volume during that time. I fully understand prior and post but not those lost 7 days thanks

What happens if you buy Tesla ON the 17th?

It should still be considered for the split as 17th is the last date.

your not a stock holder of record til 2 days after you buy. So if you buy on aug 17th your out of luck????

I think that’s why they kept a 1 week buffer period to gather all the records before splitting them.

Same question as Charles. Let’s say person A has a share on 8/17, and sold it between 8/18 and 8/24, and that share ended up being bought by person B. On 8/25 morning. Does person gets 2 shares again and person B only get 1 share of the new stock which value has been cut by 2/3?

The stocks/shares are not traded from person to person AFAIK, so, a person buying a Tesla stock after the 17th directly or from a broker will not get the benefit of the split, IMO.