During the Q1 2023 Tesla (TSLA) Earnings Call, the company’s Technoking and CEO Elon Musk openly spoke about the automaker’s future strategy to achieve profitability.

Talking to institutional investors and Wall Street journalists during the call, Elon Musk expressed that Tesla now aims to produce a high volume of cars on a lower profit margin. This is how the automaker intends to sell the maximum number of vehicles it can produce at its multiple Gigafactories around the globe.

With a substantial percentage of Tesla owners either buying or subscribing to Autopilot Full Self-Driving (FSD) in the future, Tesla expects to reap most of its margin on software rather than the car itself.

Tesla dropping the price of its cars in Q1 2023 multiple times is part of this strategy — low margin and maximum sales.

Tesla’s Full Self-Driving is currently running in beta testing mode in the United States and Canada. Although its price has reached the highest ever with $15,000 for a lifetime and $199 as a monthly subscription fee.

As Tesla expanded FSD Beta to a wide user base in North America last year, the automaker saw a spike in its monthly subscribers who wanted to experience autonomous driving in their Tesla vehicles.

This trend must have acted as a precursor to the strategy that Elon Musk announced during his opening remarks of the Tesla Q1 2023 Earnings Call (listen to the recording below).

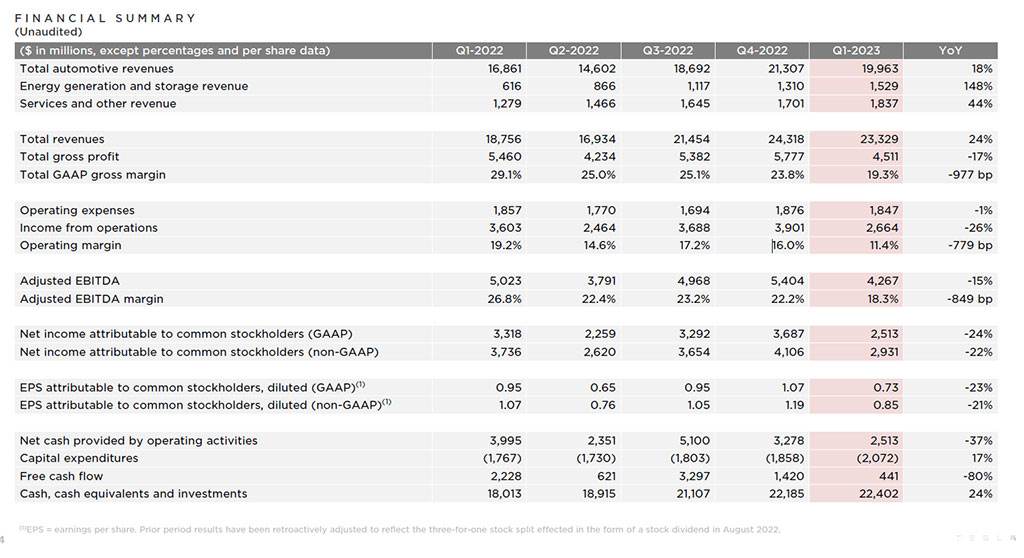

However, Musk pressed that despite the price drops during the first quarter, Tesla’s operating margins are still among the best in the automotive industry.

“While we reduced the prices considerably in early Q1, it’s worth knowing that our operating margin remains among the best in the industry,” Elon Musk said.

“We’ve taken a view that pushing for higher volumes and a larger fleet is the right choice here vs. a lower volume and higher margin,” he added.

“However, we expect our vehicles over time will be able to generate significant profit through autonomy (Autopilot/FSD),” Musk explained.

“So, we do believe we’re like laying the groundwork here and that it’s better to ship a large number of cars at a lower margin and subsequently harvest that margin in the future as we perfect autonomy, this is an extremely important point,” Elon Musk further said.

To Elon Musk, the long-term vision for Tesla has been the most important since the inception of the company. But Wall Street does not seem to be convinced this time, Tesla’s share price dropped by almost 10% (from $180.59 to $162.99) the next day after the Earnings Call took place on Wednesday, April 19, 2023.

Later on in the earnings call, Wall Street journalists kept asking the same question again and again, asking about the profitability of the next quarter and the short-term gains.

Of course, Elon Musk and his team aren’t going to commit themselves to a short-term vision and goals. A Wall Street Tesla (TSLA) investor, analyst, and YouTuber Rob Maurer discussed this in detail in the following video.

Stay tuned for constant Tesla updates, follow us on:

Google News | Flipboard | RSS (Feedly).

Related

- Tesla (TSLA) Q2 2024 Earnings Call: Elon Musk talks about Robotaxi, FSD, Optimus, Roadster, Dojo, and the next-gen affordable EV

- Tesla (TSLA) stock grew more than 40% in an 11-day rally

- Tesla (TSLA) makes a comeback with 57,146 more EVs delivered in Q2 2024 compared to Q1

- Elon Musk on Tesla (TSLA) Q1 call: 2024 deliveries, next-gen car, full autonomy, Robotaxi, more

- Tesla (TSLA) vehicle deliveries drop in Q1 2024 by 20% QoQ — but it still did better than BYD

- Tesla (TSLA) sold 1.2 million Model Y EVs in 2023, 15 GWh of energy storage, Musk predicts slower growth in 2024, more